62% feel digital transformation is a management initiative while remaining consider it as a part of optimization, says a survey with financial executives conducted by Gartner.

Imbibing from other sectors, financial institutions have recognized the potential of digital developments, solutions, and strategies that are today changing the face of the economy. However, digital ecosystems require more than just the adoption of change. In order to achieve resounding success, the institutes have to undergo structural reforms across internal and external processes and systems.

Thus, organizations are now investing in technology to one, speed-up their business endeavors and two, to differentiate from their competitors.

This harmonious integration termed as Fintech is attracting customers with products and convenient services that have emerged from a single-source technology.

Where does digital transformation fit in Finance?

The transformation brought-in by the digitalization is more on the customer front. The digital growth is thus directly proportionate to the convenience an application can provide to its customers. For instance, the banks and credit companies are now providing mobile experience and facilities to the users and eliminating the hassles of visiting a branch for petty transactions and formalities. However, financial institutions like capital and equity markets still rely on age-old systems that run on IBM frames.

Taking a customer-centric approach, the financial services providers are aiming to make the customer’s lives easier and thus unlocking opportunities in the functions of the financial domains like banking, credit and capital market.

With the right mediums of technology, they can outgrow the efficiency and surpass their own records when a successful implementation of the digital workforce will take place.

Impact of Digital Transformation on Finance

Beyond making the applications progressive and reaching out to customers, the Fintech industry takes digital transformation to develop an ecosystem of business models that calls for equal participation from all corners.

Beyond the teams, the transformation majorly takes place in capitalizing new technologies that can further enable the introduction of digital tools to enhance productivity & efficiency. For instance, the transition from hard paper documents to secured PDF or HTML formats.

However, it does come bearing a few risks. The advent of mobile banking, cashless payments, and e-wallets have hiked the security threats cases recently.

Tasks like depositing bills, making journal entries, receivable operations and allocations can now be assisted by robotics and replace human involvement.

Mitigating Challenges

In order to clear the grey clouds of challenges, financial organizations came up with strategies that can automate and digitally transform the processes. The act of automation comes with a set of rules and regulations that help achieve the high-performance goals and mitigate the operational risks.

Beginning with being strict about the guidelines of the technological applications, the Fintechs have to move on the lines of improved customer segmentation. Secondly, the enhancements in the services, design of products on offer and promotional capabilities can lend the ease of migrating from physical channels to a digital platform.

The monotonous tasks like accounting, reports, analysis and similar operations can now be executed with robust strategies of the technology that minimizes the errors and possibility of cyber risks.

Digital Tools to Support Financial Functions

There are specific tools for Fintech that serves the industry with systems focused on improving the existing competencies. These tools can deliver the intended capabilities:

Cloud Computing

The technological expedition came up with the introduction of cloud computing. Financial enterprises took the advantage to enable effective interdepartmental collaborations using SaaS-Based cloud applications. Tasks like accounting and Human Resource fell under this and the core systems got integrated.

However, for functionalities like credit scoring, billing, and payments, the same cloud structures cannot be put to use for the sheer risk of cybercrimes and loss of personal data.

Robotic Automation

Addressing the manual labor’s woes, the introduction of robotic automation in the banking sector brought down the processes and communications to a minimum. Tasks like depositing bills, making journal entries, receivable operations and allocations can now be assisted by robotics and replace human involvement. Though the initiation is still in the testing phase, banks have started installing bots at the entry gates of the branches.

Data Visualization

Data storage is another key area where the multiple departments have struggled to maintain a single and uniformed funnel. The data visualization gains insights by tracking the performance and trace the interactions that can predict or forecast the performance. This can be utilized to base decisions for profound improvements in the next stage of development.

Advanced Analytics

Since there are various sectors in finance itself, it becomes a task to channelize the load of customer data. Therefore, artificial intelligence is leveraged to effectively use advanced or predictive analytics that anticipates customer behavior. Further, the algorithms of machine learning identify the customer trends and analyze an online pattern that can be put to their advantage. For example, the apps store your most frequently used services and then give suggestions based on it.

Blockchain

The most preferred technology in the financial space is Blockchain. This amalgamation ushered financial services in a new digital era in its truest form.

Blockchain empowered a new form of currency called cryptocurrency where the set of blocks of data is considered as a currency that can be exchanged online. This major breakthrough in the financial sector sounded promising as it reduced frauds, addressed money laundering and effectively pumped trading measures in the market. However, Blockchain has a long path of transformation while it eliminates the challenges on the way.

Future of FinTech

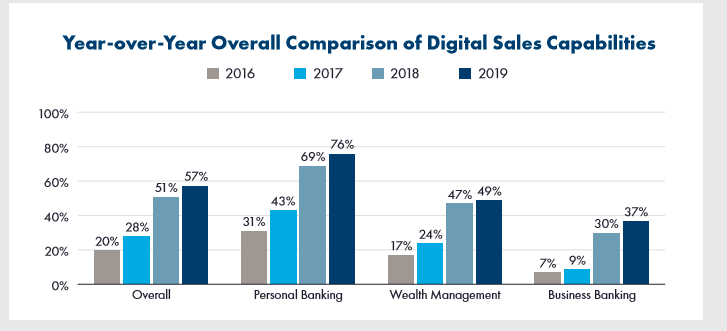

65% of banks have reached the digital promised land.

The two-dimensional platforms that serve both parties involved - clients and advisors - will take the baton of advancements. It will further empower and shape the ecosystem by embracing the newbies and tapping the digital maturity of today’s customers. With each new phase, the customers are also bridging their knowledge gaps on a learning curve of technology.

It is only a matter of time when we will witness a blooming financial sector where demanding customers and smarter tools collide for a better tomorrow.

Share your views on our social networks: Facebook, LinkedIn, and Twitter.

Subscribe

Related Blogs

Trek n Tech Annual Retreat 2025: A 7-Day Workcation of OSL

OSL family came together for the Trek n Tech Annual Retreat 2025, a 7-day workcation set amidst the serene beauty of…

Exploring Drupal's Single Directory Components: A Game-Changer for Developers

Web development thrives on efficiency and organisation, and Drupal, our favourite CMS, is here to amp that up with its…

7 Quick Steps to Create API Documentation Using Postman

If you work with API , you are likely already familiar with Postman, the beloved REST Client trusted by countless…